Dear Supporters,

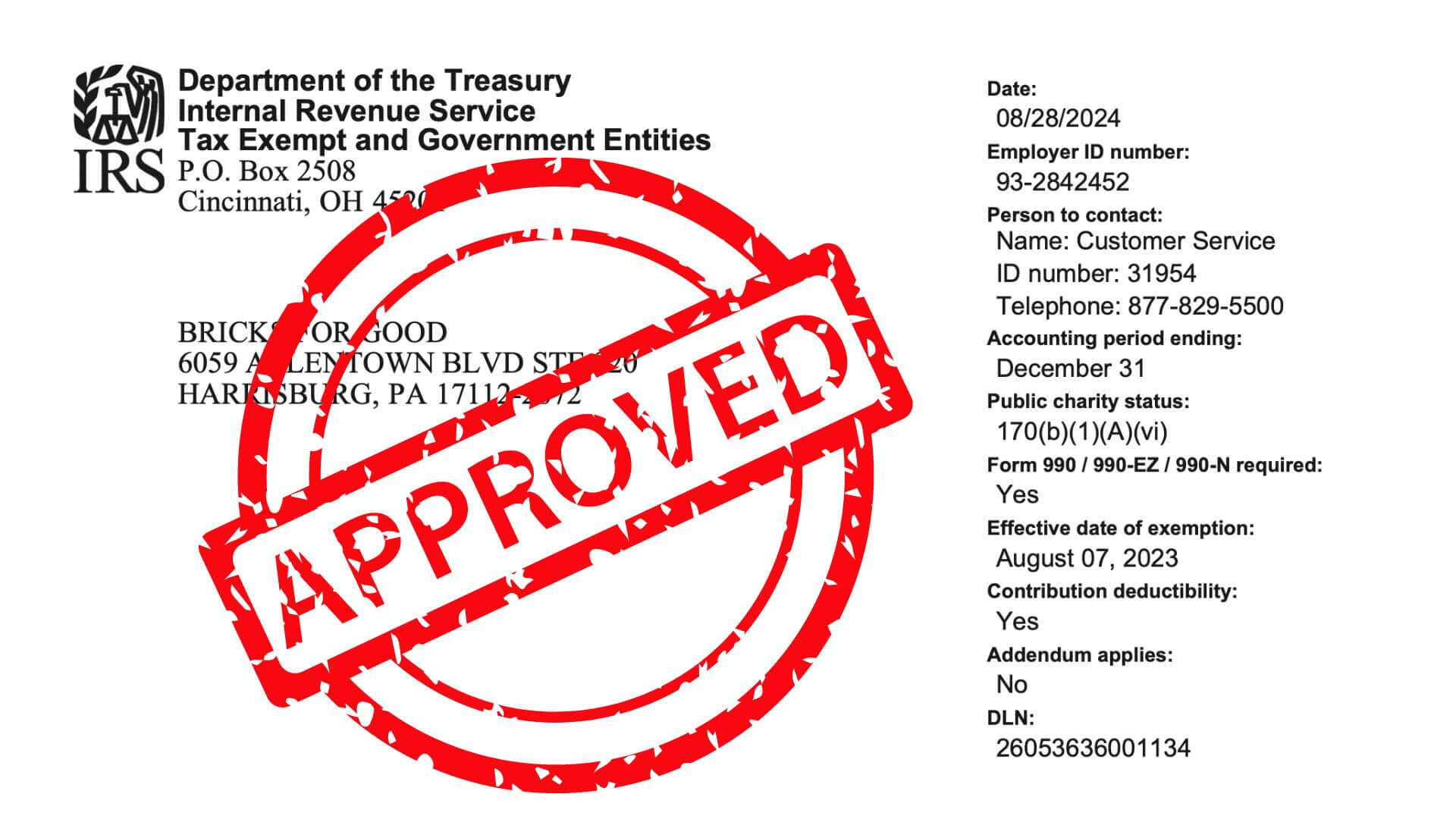

We are thrilled to share that our nonprofit organization has recently received our official 501(c)(3) tax-exempt status determination letter from the IRS. To ensure the highest quality and accuracy of our application, we took the necessary time to comprehensively address all regulatory and compliance requirements. This involved preparing detailed documentation, consulting with experts, and meticulously reviewing all aspects of our submission.

This achievement strengthens our commitment to our mission and ensures that your generous contributions to our cause are tax-deductible. We deeply appreciate your support and look forward to continuing our important work together!

Clarification Regarding Our Name

We would like to bring to your attention an important matter to avoid any confusion. We have become aware that another organization operating in California, which was established in 2024, has adopted the same name as ours and is offering services similar to those provided by our Pennsylvania-based organization. Our organization, Bricks for Good, was originally founded in 2023 and is the authentic entity with the established mission and values.

Additionally, this organization is operating an eBay store under our name, which is also not affiliated with us. We want to clarify that any transactions or interactions with this eBay store are separate from our organization.

While we are flattered that our mission has inspired others to start their own version of our work, we want to ensure that you are fully informed about which organization you are supporting. We have discussed this matter with our legal counsel and are currently reviewing options to safeguard our established name. Additionally, we have submitted a trademark registration application with the United States Patent and Trademark Office to secure our identity (™). Once approved, the registration (®) will be made effective to our date of first use and will provide federally protected rights, thereby sealing our intellectual property against any future infringement.

Use of Donations

We want to emphasize that all donations we receive are solely used to support the children we serve, as all of our operating costs are funded by our Board of Directors. It is unfortunate that the confusion caused by the other organization may impact our ability to support our mission fully by consuming our personal time and resources, but please be assured that every donation you make directly benefits our programs and services.

What This Means for You

Please ensure that any donations or support are directed to our official Pennsylvania-based organization. For any verification needs or inquiries, please contact us directly at hello@bricksforgood.org.

Note on Tax-Exempt Status

Our tax-exempt status has been made effective as of August 7, 2023. While all contributions are now considered tax-deductible to the extent allowed by law, we recommend consulting with your accountant to confirm how this applies to your personal tax situation.

Please click here to download a copy of our Determination Letter from the IRS.

Thank you for your continued support and understanding as we work through this matter. Your trust and engagement are vital to our mission, and we are dedicated to ensuring that your contributions have the greatest impact.

With heartfelt appreciation,

![]()

Lee Barber

Chairman of the Board of Directors

Bricks for Good